Higher interest rate target? Expanded mandate? Bank of Canada explores options

OTTAWA — The Bank of Canada is studying whether it should make changes to the framework that has underpinned its policy decisions — such as interest-rate movements — for several decades.

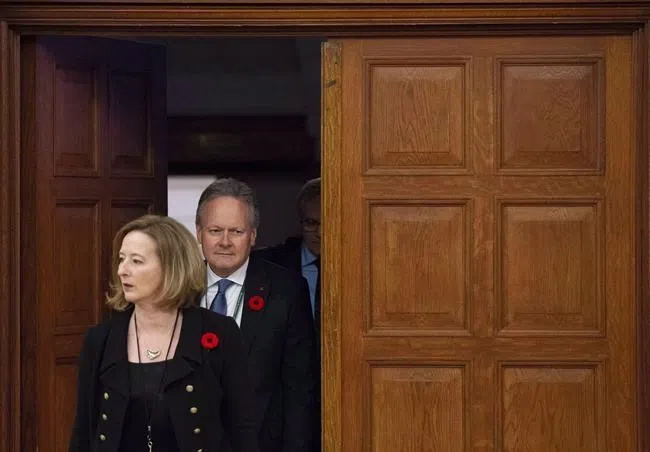

In a speech Tuesday, senior deputy governor Carolyn Wilkins said the current inflation-targeting approach has improved the economic and financial well-being of Canadians since it was established in 1991.

But after a decade in the post-financial-crisis environment, she said it has become clear there are also down sides to the bank’s mandate of helping inflation stay close to its target of two per cent.

“Even a well-functioning monetary-policy framework deserves an open-minded discussion, particularly in the post-crisis world we live in,” Wilkins said in her address to McGill University’s Max Bell School of Public Policy in Montreal.